Tag: Insurance

-

Measuring the Performance of an Insurance Company

As we are approaching year end, insurance companies should accurately measure the company’s performance. One must consider a variety of financial metrics, operational indicators, and market factors. This comprehensive approach ensures that stakeholders can assess the company’s profitability, efficiency, risk management capabilities, and overall market… Read more

-

Mergers Between Insurance Companies: A Potential Path to Failure

Mergers between insurance companies can be seen as a strategic move aimed at increasing market share, enhancing operational efficiencies, and diversifying product offerings. However, these mergers can also lead to significant challenges that may jeopardize the long-term viability of the combined entities. This analysis explores… Read more

-

Insurance Company’s Dependency on Reinsurance Brokers: Is It Wise?

Reinsurance is a critical component of the insurance industry, allowing primary insurers to manage risk by transferring portions of their risk portfolios to other parties. This process helps insurers maintain solvency, stabilize loss experience, and protect against catastrophic events. Reinsurance brokers play a vital role… Read more

-

Reinsurance Renewals for 2025: Expectations and Insights

As we approach the reinsurance renewals for 2025, several key factors are shaping the landscape. The reinsurance market is influenced by a variety of elements including economic conditions, natural catastrophe trends, regulatory changes, and evolving risk profiles. Understanding these dynamics is crucial for stakeholders in… Read more

-

Is Insurance Company a Good Investment Method?

Investing in insurance companies can be an intriguing option for investors seeking diversification and potential returns. Insurance companies operate on a unique business model that involves collecting premiums from policyholders and investing those funds to generate profits. This investment method can be assessed through various… Read more

-

The Danger of Inaccurate Insurance Figures and Its Effects on Insurance Companies and the Economy

In the insurance industry, accurate data is paramount for effective risk assessment, pricing strategies, and overall financial stability. When insurance figures are inaccurate, it can lead to a cascade of negative consequences not only for the insurance companies themselves but also for the broader economy.… Read more

-

Chronicles of the Reinsurance Industry

Reinsurance is a critical component of the global insurance landscape, providing insurers with a mechanism to manage risk and enhance their financial stability. It involves one insurance company (the ceding company) transferring a portion of its risk to another insurer (the reinsurer). This process allows… Read more

-

Leading Saudi Arabian insurance company and its continuity in the future, why? And the fate of existing insurance companies

This article is addressed to existing businesses and new businesses seeking investment opportunities in the Kingdom and looking for a solid insurance company’s foundations to protect their investments. The Saudi Arabian insurance market is undergoing significant transformation, particularly with the establishment of the new Insurance… Read more

-

Localizing Reinsurance and Its Effect

Reinsurance is a critical component of the global insurance industry, allowing primary insurers to manage risk by transferring portions of their liabilities to other parties. This process not only stabilises the financial performance of insurers but also enhances their capacity to underwrite new business. As… Read more

-

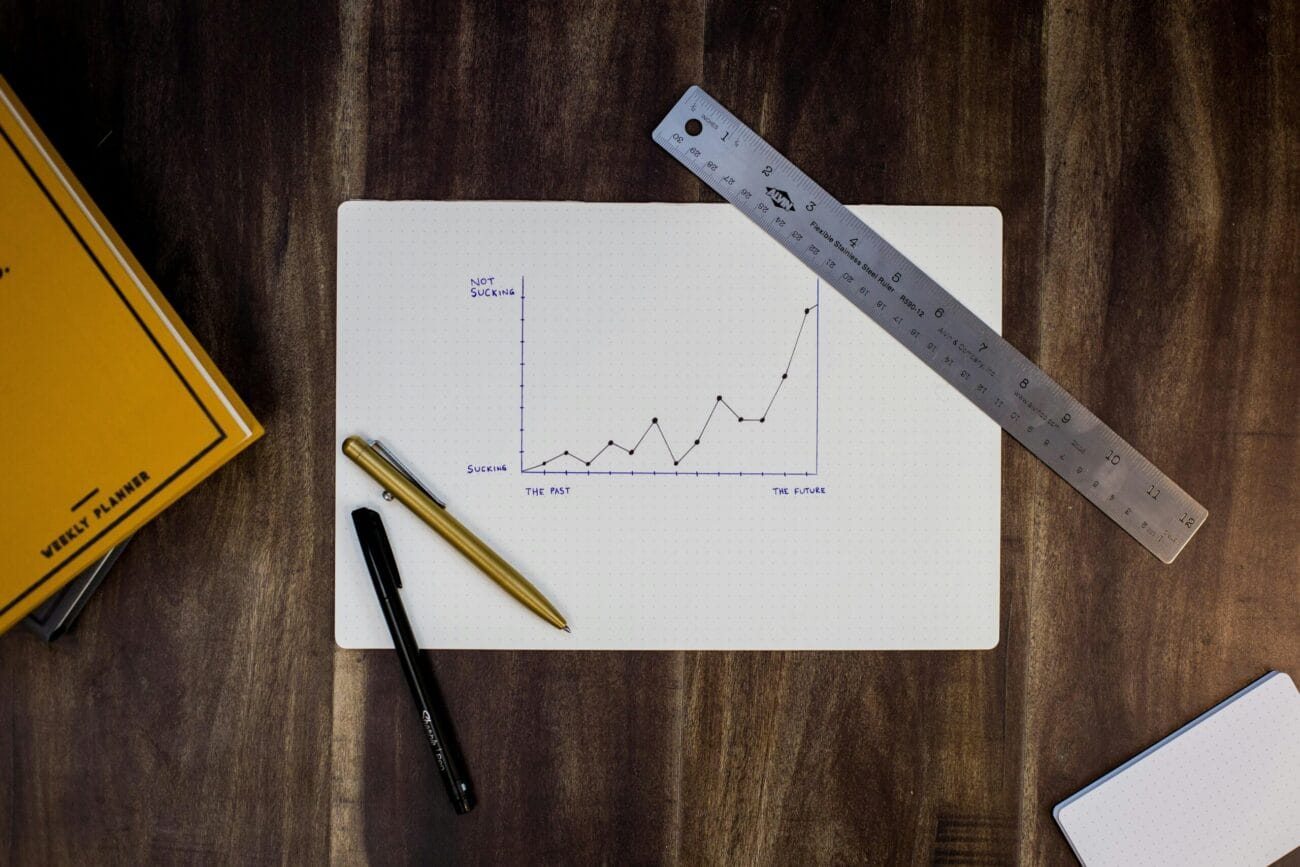

Misleading Analytical Tools

In the contemporary business landscape, data-driven decision-making is paramount. Managers rely heavily on analytical tools to interpret data, forecast trends, and guide strategic initiatives. However, these tools can sometimes be misleading, leading to erroneous conclusions and poor decision-making. Understanding how these misleading analytical tools operate… Read more